Appendix - AA ARMY SOURCE SELECTION SUPPLEMENT

The official AFARS regulation resides on the Army’s Knowledge Management Portal PAM. If you do not have CAC access to PAM, please visit the Army Contracting Enterprise’s public facing website “Army Connect” at https://www.army.mil/armycontracting#org-afars. The AFARS will return to Acquisition.gov upon completion of the RFO.

(Revised 31 December 2024)

CHAPTER 1 PURPOSE, ROLES, AND RESPONSIBILITIES

1.4 Source Selection Team Roles & Responsibilities

CHAPTER 2 PRESOLICITATION ACTIVITIES

2.1 Conduct Acquisition Planning

2.2 Develop a Source Selection Plan

2.3 Develop the Request for Proposals

2.4 Release the Request for Proposals – (No Supplemental Army Guidance)

CHAPTER 3 EVALUATION AND DECISION PROCESS

3.2 Documentation of Initial Evaluation Results

3.4 Competitive Range Decision Document – (No Supplemental Army Guidance)

3.6 Final Proposal Revisions – (No Supplemental Army Guidance)

3.7 Documentation of Final Evaluation Results

3.8 Conduct and Document the Comparative Analysis

3.9 Best-Value Decision – (No Supplemental Army Guidance)

3.10 Source Selection Decision Document

3.11 Debriefings – See Appendix A

3.12 Integrating Proposal into the Contract

CHAPTER 4 DOCUMENTATION REQUIREMENTS

4.2 Electronic Source Selection

A-3 Notification of Debriefing

A-6 Preparing for the Debriefing

A-7 Outline for the Debriefing – (No Supplemental Army Guidance)

A-9 Sample Offeror Questions – (No Supplemental Army Guidance)

B-2 Value Adjusted Total Evaluated Price Tradeoff

Appendix C Lowest Priced Technically Acceptable Source Selection Process

C-5 Quick Comparison of Best Value Basics

C-6 Comparing Key Characteristics

C-8 Common Concerns for Each Methodology

C-9 Tips and Best Practices for Using LPTA

C-10 LPTA Requirement and Standard of Proof Samples

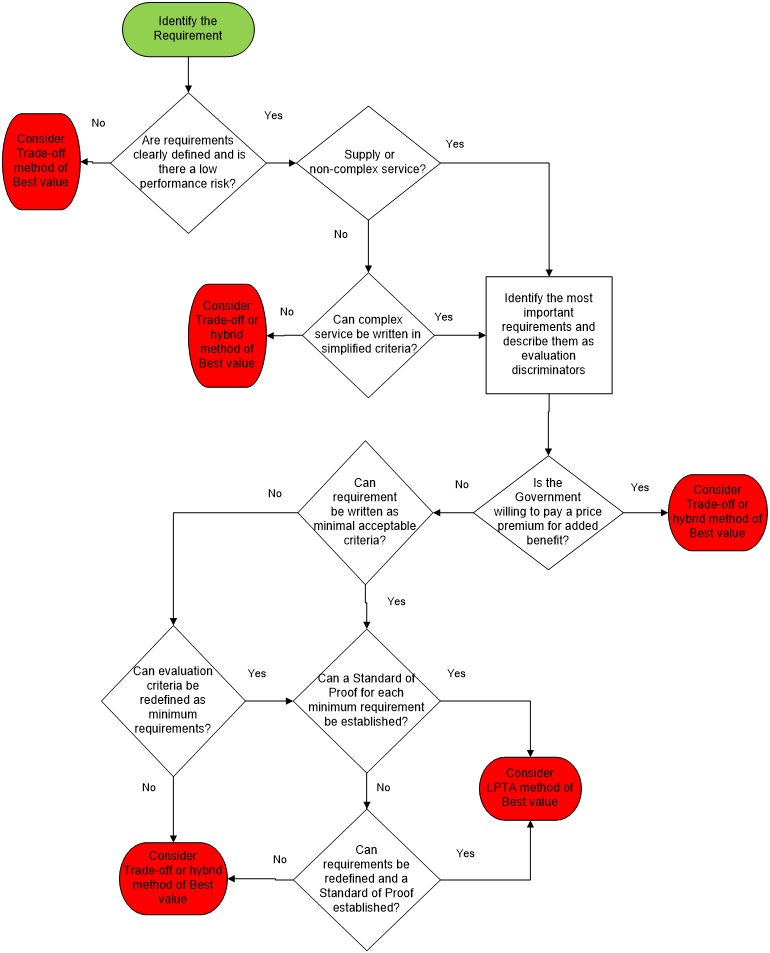

C-11 Flow Chart For Selection of Best Value Methodology

C-12 LPTA – Sample Evaluator Write-Up

Appendix D Streamlining Source Selection

D-1 General Streamlining Tactics – (No Supplemental Army Guidance)

D-2 Preparation for Proposal Evaluation and Source Selection – (No Supplemental Army Guidance)

D-3 Source Selection Management Plan – (No Supplemental Army Guidance)

D-4 Tiered or Gated Approaches – (No Supplemental Army Guidance)

D-6 Using Demonstration in Source Selection – (No Supplemental Army Guidance)

D-7 Highest Technically Rated Offeror (HRTO) Approach – (No Supplemental Army Guidance)

D-8 Performance Price Tradeoff – (No Supplemental Army Guidance)

D-9 Useful Websites and Training

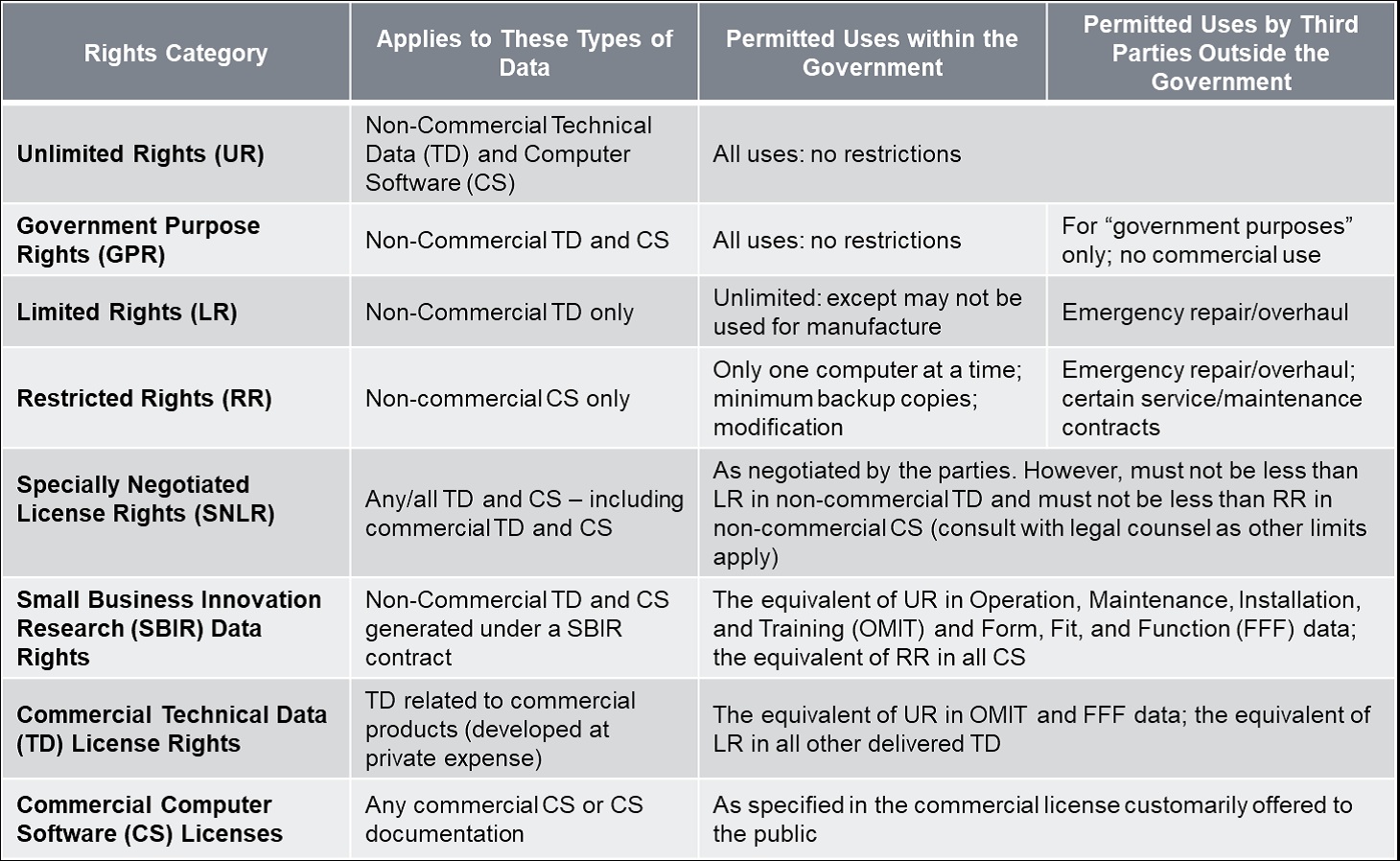

Appendix E Intellectual Property, Data Deliverables, and Associated License Rights

CHAPTER 1 PURPOSE, ROLES, AND RESPONSIBILITIES

E-1.2 Applicability and Waivers – (No Supplemental Army Guidance)

E-1.4 Source Selection Team Roles and Responsibilities

CHAPTER 2 PRESOLICITATION ACTIVITIES

E-2.1 Conduct Acquisition Planning

E-2.2 Develop a Source Selection Plan (SSP)

E-2.3 Develop the Request for Proposals (RFP)

CHAPTER 3 EVALUATION AND DECISION PROCESS

E-3.2 Documentation of Initial Evaluation Results – (No Supplemental Army Guidance)

E-3.3 Award Without Discussions – (No Supplemental Army Guidance)

E-3.4 Competitive Range Decision – (No Supplemental Army Guidance)

E-3.5 Discussion Process – (No Supplemental Army Guidance)

E-3.6 Final Proposal Revisions – (No Supplemental Army Guidance)

E-3.7 Documentation of Final Evaluation Results – (No Supplemental Army Guidance)

E-3.8 Conduct and Document the Comparative Analysis – (No Supplemental Army Guidance)

E-3.9 Best-Value Decision – (No Supplemental Army Guidance)

E-3.10 Source Selection Decision Document – (No Supplemental Army Guidance)

E-3.11 Debriefings – See Appendix A of the AS3

E-3.12 Integrating Proposal into the Contract – (No Supplemental Army Guidance)

CHAPTER 4 DOCUMENTATION REQUIREMENTS

E-4.1 Minimum Requirements – (No Supplemental Army Guidance)

E-4.2 Electronic Source Selection – (No Supplemental Army Guidance)

CHAPTER 6 Laws, Regulations, and Policies

CHAPTER 9 Templates – Sections L & M

Technical Volume: Intellectual Property, Data Deliverables, and Associated License Rights

Diminishing Manufacturing Source and Material Shortage (DMSMS)

Hardware Sustainment Activities

Modular Open Systems Approach (MOSA) (10 U.S. Code § 4401)

Operation, Maintenance, Training, and Installation

Operator and Maintainer Training

Organic Field Level Support Provisioning

Product Support/Sustainment Strategy

Software Sustainment Environment (SSE)

Test, Troubleshooting, and Repair

Appendix F Small Business Participation Commitment Document

Appendix G Online Reverse Auctions

G-2 Applicability to Best Value Acquisitions

CHAPTER 1 PURPOSE, ROLES, AND RESPONSIBILITIES

1.1 Purpose

The Army Source Selection Supplement (AS3) implements and supplements the mandatory Department of Defense (DoD) Source Selection Procedures to establish consistent policies and procedures for Army source selections. The Federal Acquisition Regulation (FAR) and its supplements (Defense FAR Supplement (DFARS), DFARS Procedures, Guidance, and Information (PGI), Army FAR Supplement (AFARS) and the AFARS PGI) prescribe the general policies governing these acquisitions.

1.2 Applicability and Waivers

The AS3 applies to best value, negotiated, competitive source selections with an estimated value greater than $10 million, and may also be used as guidance in all other acquisitions. DoD Source Selection Procedures: https://www.acq.osd.mil/dpap/policy/policyvault/USA000740-22-DPC.pdf, Paragraph 1.2, content for applicability and waivers also applies to Army waiver procedures.

The AS3 is not a stand-alone document and shall be used in conjunction with FAR Part 15, DFARS and DFARS PGI Subpart 215, AFARS and AFARS PGI Subpart 5115 and the DoD Source Selection Procedures. Any conflicts shall be resolved through the Office of the Deputy Assistant Secretary of the Army (Procurement) (ODASA(P)), Policy Directorate, mailbox usarmy.pentagon.hqda-asa-alt.mbx.office-of-the-dasa-p@army.mil.

Any request for waiver of the DoD Source Selection Procedures shall be submitted by the cognizant Senior Contracting Official (SCO), through their Head of the Contracting Activity (HCA), to the DASA(P), Attn: Policy Directorate (SAAL-PP). ODASA(P) will process all waivers as follows:

For solicitations valued at $1 billion or more, waivers may only be approved with the express, written permission of the Director, Defense Pricing, Contracting, and Acquisition Policy (DPCAP).

For solicitations valued below $1 billion, waivers must be approved by the DASA(P).

1.3 Best Value Continuum

Subjective Tradeoff. Use of subjective tradeoff is appropriate for most Army source selections. See Appendix B for more information. (Reference DoD Source Selection Procedures https://www.acq.osd.mil/dpap/policy/policyvault/USA000740-22-DPC.pdf , Section 1.3.1.3)

Value Adjusted Total Evaluated Price (VATEP). Use of VATEP may be most suitable for procuring developmental items when the government can determine the value (or worth) of “better performance” and quantify it in the Request for Proposal (RFP). See Appendix B for more information. (Reference DoD Source Selection Procedures 1.3.1.4)

1.4 Source Selection Team Roles & Responsibilities

Source selection is a multi-disciplined team effort. The Source Selection Team (SST) should include representatives from appropriate functional areas such as contracting, small business, technical, logistics, cost/price, legal, and program management. User organizations should also be represented.

The success of any source selection is usually determined by the personnel involved at all levels, and their degree of active participation. Likewise, the Source Selection Authority (SSA), with assistance from the SCO, will ensure the appointment of personnel with the requisite skills, expertise, and experience to ensure the success of the source selection, to include members appointed to the Source Selection Advisory Council (SSAC).

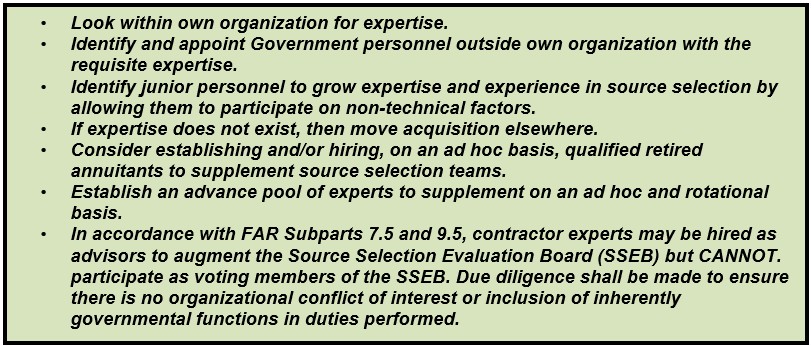

The SCO is responsible for determining the capability of the organization to effectively resource the SST as set forth in the hierarchy of source selection expertise below (See Figure 1-1). In the event the SCO determines the required expertise is not obtainable, the HCA will be consulted. If the HCA concurs the appropriate resources are still unavailable, the DASA(P) will be notified and will assist in providing resources from other contracting activities or assign the procurement to another contracting activity for execution.

Figure 1-1: Hierarchy of Source Selection Expertise

The size and composition of the SST will vary depending upon the requirements of each acquisition. For example, major hardware acquisitions frequently involve requirements impacting various organizations from across the Army (or from other services on joint-service programs). In such cases, and when forming the SST, SSEB Factor/Subfactor teams should include evaluator representation from each major requirements organization. These evaluators should be assigned to the evaluation criteria associated with their specific area of requirements and expertise. Inclusion of technical evaluators who are subject matter experts on the requirement(s) being evaluated is essential to a successful evaluation process providing fair/accurate assessment of the proposals, and absolutely critical where joint-service and/or multiple functional requirements are involved.

Whether the team is large or small, it should be structured to ensure teamwork, unity of purpose, and allow for appropriate open communication among the team members throughout the process. This will facilitate a comprehensive evaluation and selection of the best value proposal.

Key Components of the SST

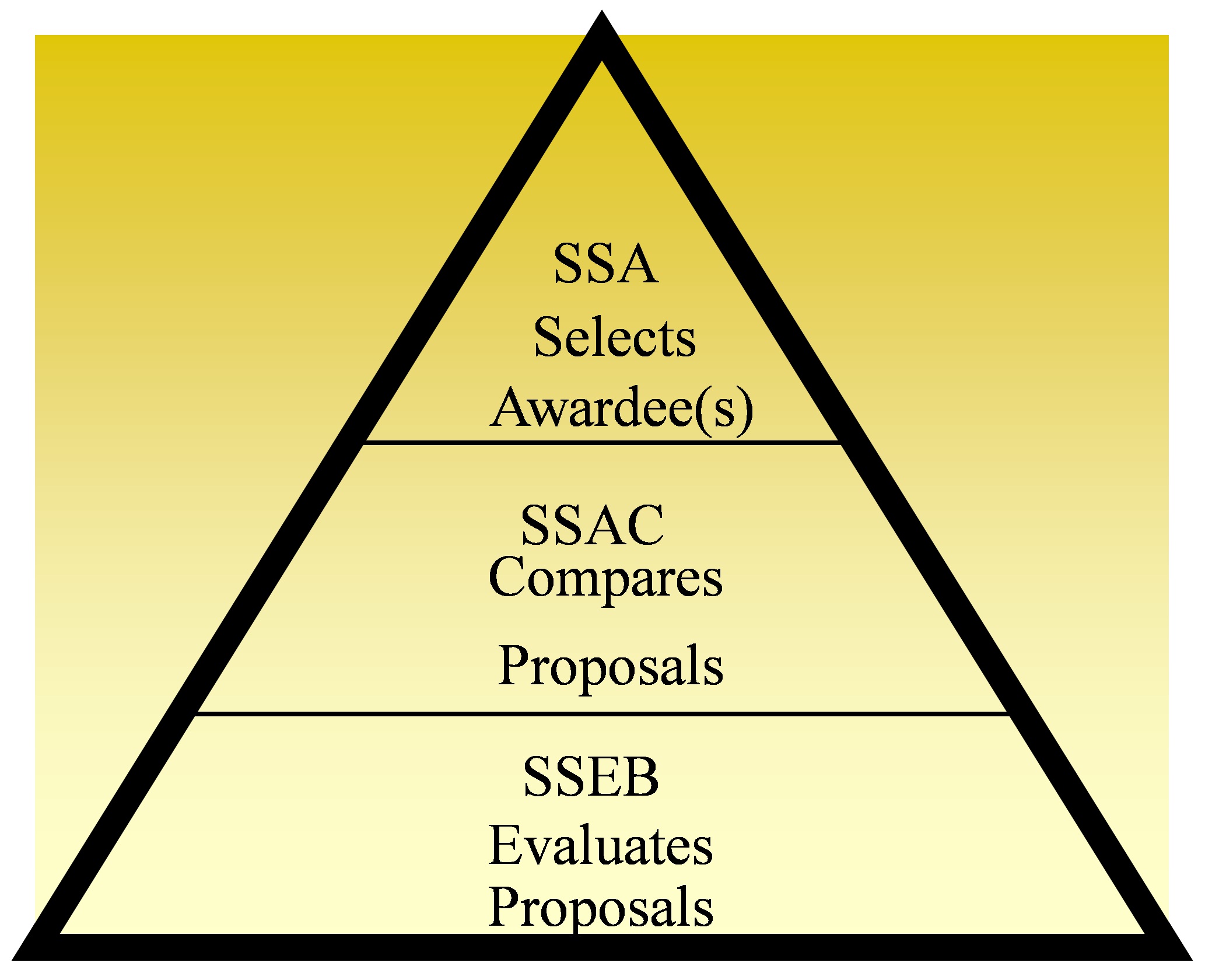

For source selections with a total estimated value of $100M or more, the SST shall consist of the SSA, a SSAC, and an SSEB. Each of these SST entities has distinct and separate functions (See Figure 1-2).

Figure 1-2: SST Responsibilities

NOTE: Source selections using LPTA methodology do NOT require the SSAC or require a SSAC Report be prepared.

The SSEB is usually comprised of multiple groups of evaluators who are responsible for evaluating specific areas of the proposal against the RFP requirements. Additionally, legal counsel, small business professionals, cost/price, and technical experts may also serve as SST advisors. The precise structure of the SSEB is a matter within the SSA’s discretion.

The information below supplements the Roles and Responsibilities found in the DoD Source Selection Procedures (See paragraph 1.4).

The SSA.

Appointment. The AFARS 5115.303 provides the policy on SSA appointments.

o All appointed SSAs are considered procurement officials and are subject to the associated statutory / regulatory rules.

o Once appointed, the SSA cannot further delegate their SSA authorities.

o For source selections exceeding $100M, the SSA is other than the PCO.

Ensures the Source Selection Plan (SSP) and evaluation criteria are consistent with the requirements of the solicitation and applicable regulations.

NOTE: The identity of the SSA shall be considered procurement sensitive and shall not be disclosed to anyone who has not signed a non-disclosure agreement for that RFP / acquisition.

The Procuring Contracting Officer (PCO).

(No Supplemental Army Guidance.)

The SSAC.

The SSAC will consist of senior government personnel and may include representation from the cognizant contracting office and legal office.

For Acquisition Category I/II source selections involving requirements organizations from across the Army (or from other services on joint-service programs), the SSAC must include representation from all significant requirements organizations. The SSAC representatives must be at an organization / grade level commensurate with the other members of the SSAC, usually military 0-6/GS-15 or higher.

The SSEB.

The SSEB Chairperson.

o Ensures the SSEB members understand the evaluation criteria and establishes a uniform approach to the evaluation and rating effort. Seeks to build consensus among the SSEB members.

o Isolates policy issues and major questions requiring decision by the SSA.

o Relieves and replaces SSEB members from assignment only in the event of a demonstrated emergency or other appropriate cause.

o Arranges for the SSEB members to work compensatory time, when necessary, authorized, and approved.

o Arranges for the needed administrative staff at the evaluation work site.

The SSEB Members.

o Prepare the evaluation notices (ENs).

o Briefs the SSAC/SSA (as requested) and responds to comments / instructions from the SSAC/SSA.

Legal Counsel.

Non-disclosure agreements (NDAs) will not be requested or required of HQDA Office of General Counsel (OGC) attorneys.

Other Advisors.

(No Supplemental Army Guidance.)

Program Manager (PM) / Requiring Activity (RA).

(No Supplemental Army Guidance.)

Small Business Team.

Assists requirements office and PCO with Market Research during planning and throughout the various acquisition phases.

Assists in shaping Acquisition Strategy in support of small businesses when applicable.

Provides review of draft and final documents prior to release to potential offerors.

Tools.

Army’s Virtual Source Selection Advisory Team (VSSAT) Tile is accessible through Army’s Knowledge Management Portal Procurement.Army.Mil (PAM) Source selection tile ( https://armyeitaas.sharepoint-mil.us/sites/ASA-ALT-PAM-ProcProc/SitePages/SourceSelection.aspx).

Administrative Support.

Each acquisition will vary in terms of the administrative support requirements.

Figure 1-3 on the following page contains a checklist of some important requirements common to many acquisitions.

Figure 1-3: Administrative Support Requirements

CHAPTER 2 PRESOLICITATION ACTIVITIES

2.1 Conduct Acquisition Planning

Acquisition Planning. Acquisition planning should start when an agency identifies a need for supplies, construction and/or services. When practical, utilize an integrated product team (IPT) approach to develop the acquisition plan and/or strategy as required. This early teaming effort may reduce false starts and resulting delays that frequently accompany the preparation of a complex procurement. (Reference DoD Source Selection Procedures 2.1.1)

Best Practice: Some of the decisions/determinations made during the planning phase are key and will impact the entire acquisition from source selection through contract administration. Including key stakeholders, such as contract administrators, small business professionals (SBPs), Contracting Officer’s Representatives (CORs), Quality Assurance (QA) and Property Administrator, will help to ensure consideration of issues that may impact the requirements, performance, and acquisition strategy as a whole.

Risk Assessment. Risk analysis is a critical component of acquisition planning, and the market research results should be a primary consideration as part of this analysis. Early identification, formation, and direct involvement of the acquisition team (and key stakeholders) will help to ensure a comprehensive understanding of the requirements and any marketplace influences on risk and risk mitigation. (Reference DoD Source Selection Procedures 2.1.1.2)

Peer Reviews. See AFARS 5101.170 for Preaward peer reviews. Planning and including realistic time allowances for all requisite reviews when establishing milestone schedules, is essential to the success of your acquisition.

Market Research. Market research is a shared responsibility and continuous process conducted by the PM, requiring activity, PCO, SBP, and other acquisition team members which directly influences how the acquisition strategy and source selection process is shaped. (Reference DoD Source Selection Procedures 2.1.2 and AFARS 5110.002)

Some techniques you may use in conducting market research include:

Use general sources of information available from the marketplace, other DoD/ government agencies, and the internet.

Contact knowledgeable individuals, such as SBPs, regarding market capabilities and business practices.

Review the results of recent market research for same or similar requirements.

Query government and/or commercial databases (e.g., Dynamic Small Business Search https://dsbs.sba.gov/search/dsp_dsbs.cfm, System for Award Management (SAM.Gov); https://sam.gov/content/home.)

Conduct industry engagement/industry days in coordination with supporting Small Business Office.

Prepare a draft Request for Proposal (RFP) and ensure review by a SBP prior to issuing. (DoD Source Selection Procedures 2.1.2.3)

2.2 Develop a Source Selection Plan

Selection of Evaluation Factors. Selecting the correct evaluation factors is the most important decision in the evaluation process. Structure the evaluation factors and their relative importance to clearly reflect the needs of your acquisition, with consideration given to the inclusion and evaluation of intellectual property/data rights and what is necessary and prudent be included in the acquisition.

Mandatory Evaluation Considerations. For source selections, you must evaluate cost/price (unless the exception at FAR 15.304(c)(1)(ii)(A) applies) and the acceptability/quality of the proposed product or service through one or more non-cost evaluation factors (e.g., past performance, technical excellence, management capability, and key personnel qualifications).

As stated at FAR 15.304(c)(1)(ii)(A)), the PCO may exclude cost/price as an evaluation factor for a Multiple Award IDIQ effort issued for the same or similar services if the Government intends to make award to all "qualifying offerors" and Cost/Price will be considered as one of the factors for all tasks/delivery orders.

Additionally, you must evaluate past performance on all negotiated competitive acquisitions expected to exceed the thresholds identified in FAR 15.304 and DFARS 215.304, unless the PCO documents why it would not be appropriate. There may be other required evaluation factors, such as small business participation, based upon regulatory and/or statutory requirements. (See FAR 1 5.304 and its supplements)

From this vantage point, the acquisition team must apply prudent business judgment to add other evaluation factors, subfactors, and elements that are important to selecting the most advantageous proposal(s). The number of factors and subfactors should be kept to the absolute minimum required to effectively assess the proposal(s). The use of more factors than needed to conduct the evaluation can complicate and extend the process, while providing no additional value and thereby diluting meaningful discriminators. Limiting factors also serves to reduce the evaluation oversight span-of-control responsibilities of the SSEB leadership, SSA/SSAC, PCO, and legal counsel, thereby permitting more focused oversight on the remaining (and most important) factors/subfactors and reducing the likelihood of evaluation errors.

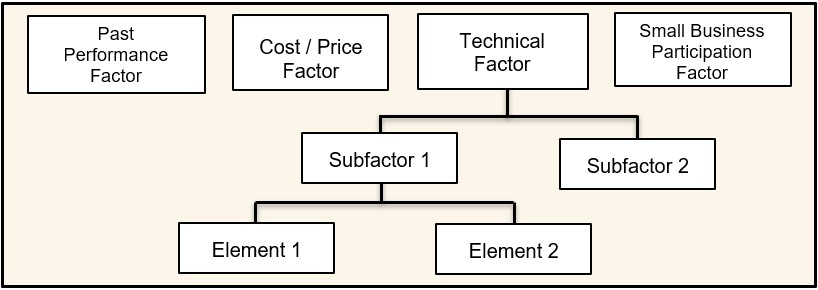

Common evaluation factors are cost/price, technical, past performance, and small business participation.

NOTE: Ensure small business participation remains an independent factor, not subordinate and a subfactor to any other evaluation factor. Additionally, if appropriate for the requirement, you may have other evaluation factors and/or may use one or more levels of subfactors. The standard Army naming convention for the various levels is: Evaluation Factor, Subfactor, and Element. (See Figure 2-1)

Figure 2-1: Sample Evaluation Factor Structure

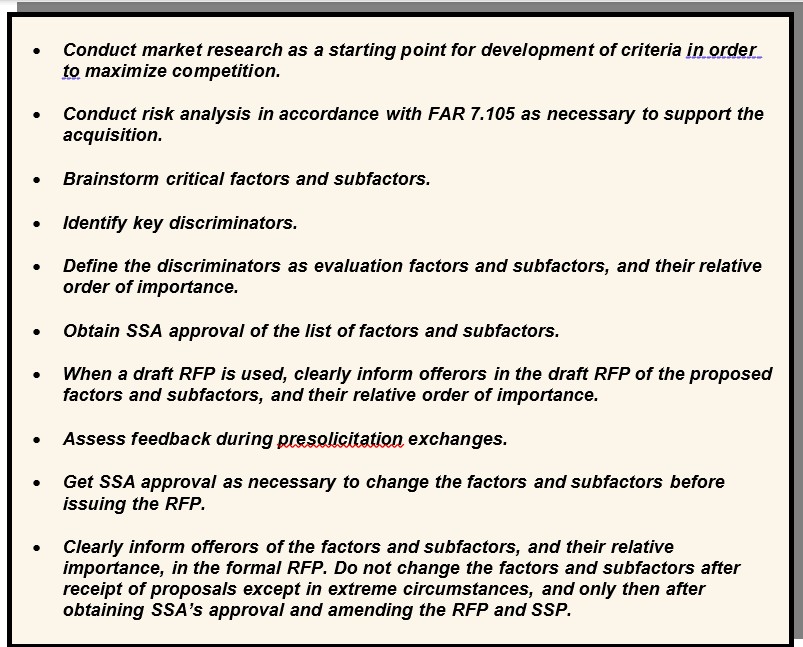

Establishing Evaluation Factors and Subfactors. The acquisition team develops the evaluation factors and any appropriate subfactors and elements. The team should select the factors based on user requirements, acquisition objectives, thorough market research and risk analysis. Figure 2-2 illustrates the steps involved in developing the factors and subfactors. The use of elements should only be utilized on rare occasions. (AFARS 5115.304)

Once the RFP is issued, the factors and subfactors give the offerors insight into the significant considerations the government will use in selecting the best value proposal and help them to understand the source selection process. Carefully consider whether minimum “acceptable/unacceptable” entry-gates can be included.

The team must also specify whether technical ratings will be applied at the subfactor level or rolled up to the factor level, with the information contained and clearly stated in the RFP so all stakeholders know how the evaluation of ratings will be applied.

NOTE: The Small Business Subcontracting Plan is not a factor or subfactor to be rated but, as stated at FAR 19.705-4, shall be reviewed for adequacy and determined to be “acceptable or unacceptable based the requirements identified at FAR 19.704. When used properly, this use of entry-gate criteria can streamline the evaluation process significantly.”

Figure 2-2: Steps Involved in Formulating Evaluation Factors and Subfactors

Nongovernment Advisors. Allowance and guidelines for use of contracted advisory services is stated at FAR 37.203, FAR 37.204, and FAR 37.205. If utilized, prior to issuing a solicitation, the head of the agency shall make a written determination based on availability of qualified personnel withing the agency. Nongovernment advisors may assist in and provide input regarding the evaluation, but they shall not determine ratings or rankings of the offeror’s proposals. Recommend clarifying allowances and or access that will be given the advisors (e.g., access to the entire proposal or only access to the part concerning their particular expertise? Can they write strengths and weaknesses or only assist other evaluators in this process? Can they participate in the consensus process without participating in/providing input for the rating assignment?).

Reminder, nongovernment sources can include academia, nonprofit institutions, and industry.

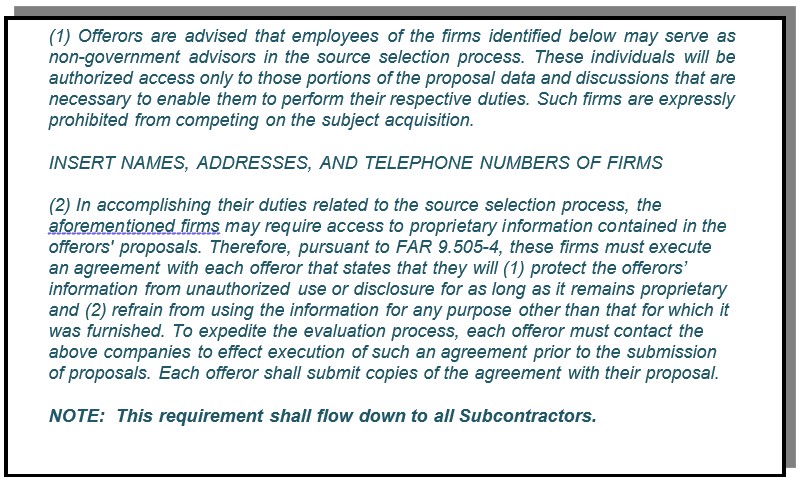

Reminder: When using nongovernment advisors, you must advise potential offerors of the nongovernment advisors’ participation in the source selection and obtain the offerors consent to provide access to its proprietary information to the nongovernment advisor or the company which employs the nongovernment advisor. Figure 2-3 identifies suggested RFP language relative to the use of commercial firms to support the source selection process. (Reference DoD Source Selection Procedures 2.2.8)

Figure 2-3: Suggested RFP Language for the use of Nongovernment Advisors

Source Selection for Services. The source selection process for services, including development of the SSP, is often very complex. Organizations must ensure that the SST is comprised of qualified personnel with specific knowledge of the types of services to be acquired.

The use of Sample Tasks is an effective tool in the evaluation of services. Sample Tasks can provide insight as to the offeror’s level of understanding of the work to be performed, as well as how the technical approach relates to the cost/price proposed for that Sample Task. (See Appendix H for an example of a Sample Task.)

To the maximum extent practicable, sample tasks should set forth requirements that are contemplated for award, establishing the expectation that offerors will be held accountable for the resources and costs they propose.

The use of generic or hypothetical sample tasks may unintentionally create an environment that misleads offerors to understate resources and costs due to the fact that the sample tasks will not be awarded. Care must be taken to draft the sample tasks as closely as possible to the types and scope of services expected to be acquired from the Performance Work Statement (PWS). If possible, consider the use of a “live” task, which would be awarded at time of contract award.

Evaluation criteria should be limited to essential areas of performance that are measurable during the proposal evaluation process. This will permit a more focused evaluation of the offeror’s proposed solution to the sample task.

If utilizing a sample task, ensure this is accounted for and aligned with Sections L and M (or equivalent sections for procurements not using uniform contract format (UCF)).

2.3 Develop the Request for Proposals

The success of an acquisition is directly linked to the quality of the RFP. A well-written RFP will:

Facilitate fair competition;

Convey a clear understanding of the government’s requirements;

Clearly identify the evaluation and award criteria;

Clearly detail information required by the offerors;

Limit criteria to discriminators that are not overly restrictive, but add value and reduce risk;

Preserve the offeror’s flexibility to propose innovative solutions when appropriate;

Specify areas where the offerors can make technical and cost tradeoffs in their proposals;

Ensure that Sections L and M (or equivalent sections) relate back to each other and the SSP.

Ways to Improve the RFP Process

Ensure Consistency in the RFP and Related Documents. RFP inconsistencies can create ambiguity and result in less advantageous offers, require RFP amendments, cause delays in the acquisition, and result in litigation. Inconsistencies between the descriptions of the government’s requirements, instructions on how to prepare a proposal, and information related to the evaluation factors and subfactors are particularly troublesome and can be a result of various groups of personnel developing different RFP sections without adequate coordination and review. Additionally, when one document is revised, those revisions must also be made to other corresponding documents.

It may be beneficial to develop a matrix that correlates the RFP sections and content to ensure consistency. Figure 2-4 illustrates how key documents and evaluation standards map to one another, showing the recommended sequencing for document preparation. Providing industry with a similar copy of the matrix as a reference tool and part of the solicitation can aid in proposal preparation. You may also consider including a column for offerors to complete in the tracking matrix (as shown in Figure 2-4), denoting where in their proposal the requirement is addressed. This approach promotes understanding of the linkage within the solicitation, explains how all parts of the proposal will be used in the evaluation process, and enables a crosswalk for both the government and offerors to ensure all requirements have been addressed.

| SPECIFICATION AND PWS | EVALUATION FACTORS, SUBFACTORS EVALUATION AND SUBMISSION INFORMATION | PROPOSAL REFERENCE | ||

| SPECIFICATION | PWS | PROPOSAL EVALUATION INFORMATION RFP Section M Factor – Technical Subfactor – Software Modification Approach | PROPOSAL SUBMISSION INFORMATION RFP Section L | OFFEROR TO COMPLETE Provide Page and Paragraph Number Where Addressed |

| Software code shall meet the computer software design and coding requirements as defined in International Standards Organization (ISO) 9000-3. | 3.1.1. The contractor shall modify, integrate and test software as specified in the system specification. 3.1.1.3 The contractor shall prepare a software modification plan. | The offeror’s software modification approach will be evaluated relative to the modified software’s ability to accommodate open architecture, tracking accuracy, and reliability. | The offeror will describe its approach to software modification and explain how the software will accommodate open architecture, conforms to ISO-9000-3, tracks accurately, and maintains reliability. | |

Figure 2-4 Requirements to RFP to Proposal Tracking Matrix

Avoid Requesting Too Much Information from the Offerors. Instructions for preparing and submitting proposals are critical to the acquisition. Always keep in mind:

There must be a direct linkage between solicitation requirements and objectives, each evaluation factor and subfactor, and the proposal preparation instructions.

Request only the essential information needed to evaluate proposals against the evaluation factors and subfactors.

Never ask for information that will not be evaluated. Instructions that require voluminous information can unintentionally limit or reduce competition by causing potential offerors to forego responding to the solicitation in favor of a less costly business opportunity.

Excessively large proposals may increase the time and costs associated with performing the evaluation. Specific guidance such as proposal page limitations or page recommendations and narrative font style and size are encouraged but need to be clearly defined and tailored to the needs of the acquisition.

Focus exclusively on true discriminators (discriminators linked to critical requirements which are based on market research, the assessment of risk, and that enables the evaluation to discern between various values in the offeror’s proposal). Failure to do so dilutes the evaluation and compromises the SSA’s ability to identify the best value proposal.

Use performance-based requirements but remain mindful that design requirements that are too detailed, or overly prescriptive performance work statements, severely limits the offerors’ flexibility to propose their best solutions. Instead, use functional or performance-based requirements to the maximum extent practicable. While it may be more difficult to develop evaluation criteria and conduct the evaluation process using this approach, the benefits warrant and support it. These benefits can include increased competition, access to the best commercial technology, better technical solutions, and fewer situations for protests.

Drafting Instructions to Offerors (Section L or Equivalent)

Provide specific guidance to offerors regarding the structure of their proposals. The proposal should be divided into distinct volumes or files. These volumes/files should correlate to each of the evaluation teams (e.g., technical, cost/price, past performance, etc.) or factors. How each volume/file is to be structured should be stated. These practices will facilitate distributing and aligning the proposal material to the various teams or specific factors, making it easier for evaluators to locate specific information in the proposals.

NOTE: Clearly advise offerors to keep technical and pricing information separate and not inter-mixed between proposal volumes.

Past Performance Information . Tailor the proposal submission requirements to reflect the complexity of the procurement and the relative importance assigned to past performance. Request only the information necessary for the evaluation. Consider the following when developing proposal submission requirements:

Contract references. Request offerors to submit a list of government and non-government contract references to include joint venture participation. References are to include contract number, contract type and dollar value, place of performance, date of award, whether performance is on-going or complete, extent of subcontracting, and the names, phone numbers, and e-mail addresses of at least two points of contacts for each contract.

o Require the list to include all relevant on-going contracts, or contracts completed during a specified period. This approach will provide an ‘unfiltered’ view of the offeror’s contract efforts, not just the ‘select’ contract efforts. If you anticipate the number of contracts will be excessive, limit the submission to a specified number of the most recent, relevant contracts. In such cases, require the contracts to have been active for a specified period of time, since newly awarded contracts will probably not provide sufficient information.

o Recommend limiting the specified period to contracts performed within the last three years, or no greater than six years for simple construction, architect-engineering (A-E) contracts, and more complex works. Recency of past performance should be calculated using the RFP release date as a benchmark. A shorter period may be appropriate for acquisitions where there are numerous actions and/or many vendors providing the required items.

o When appropriate and determining recency for certain types of large construction works (e.g., military housing, navigation projects or other large civil works), a greater time period in excess of six years should be considered and used to obtain realistic examples of past performance.

o When offerors are likely to be large, multi-function firms, limit the contract references to those performed by the segment of the firm (e.g., division, group, and unit) that is submitting a proposal.

Past Performance Information of a Prospective Subcontractor. When planning how a subcontractors’ past performance is intended to be evaluated, explain how any related adverse past performance information will be handled. In some acquisitions, an offeror’s prospective subcontractor may be the offeror’s competitor on other acquisitions. In such cases, the prospective subcontractor may be hesitant to have any adverse information related to its past performance released to the offeror. The acquisition should be tailored accordingly and advise offerors in the RFP how the disclosure of such information will be handled.

Questionnaires.Questionnaires or interviews may be utilized to obtain the information from individuals having knowledge about the offeror’s past performance, and details such as contract points of contact (name, email, and phone numbers) shall be included in the information provided back to the government in the proposal.

Consider the following when using questionnaires:

o Keep the questionnaire short. Typically, it should be no longer than 1-2 pages.

o Format the questionnaire to easily facilitate electronic completion (e.g., fill-in blocks, and electronic checkboxes).

o Include a copy of the questionnaire in the RFP.

o Either distribute the questionnaires to the points of contact or have the offerors distribute the questionnaires. Prior to the government sending out the questionnaires, and when practical, contact the respective points of contact and emphasize the importance of the completed questionnaires returned to the government promptly. Having the offerors send out the questionnaires may save time and resources.

Small Business Participation Past Performance. All offerors shall submit information substantiating their past performance and compliance with FAR 52.219-8 Utilization of Small Business Concerns, FAR 52.219-9 Small Business Subcontracting Plan, and DFARS Subpart 215.305 Proposal Evaluation, to maximize opportunities for small business subcontractors. Offerors shall also provide a statement indicating whether any negative information has been reported in the past three years (or other number of years as identified in the solicitation) concerning their past compliance with FAR 52.219-8 or FAR 52.219-9. If any such negative information is reported, the offeror may submit explanations or comments responding to such negative information. Offerors with no prior contracts containing FAR 52.219-8 and/or 52.219-9 shall certify stating as such. For other than small business, include SF 294 and SF 295 (or Individual Subcontracting and Summary Subcontracting Reports in eSRS) information for Government contracts with these reporting requirements for the last X (fill in number, same as period stated elsewhere for past performance) number of years.

Relevant Past Performance. Include in the RFP a definition of what constitutes relevant past performance. Factors that may be used to define relevancy include similarity, size, complexity, dollar value, contract type, and degree of subcontracting/teaming. As appropriate, require the offeror provide a description of how the contract references are relevant to the immediate acquisition. In some cases, previous contracts as a whole may be relevant to the immediate acquisition, while only portions of other contracts may be relevant.

Small Business Participation . The Army methodology for evaluating small business participation in unrestricted source selections is to establish a separate factor (versus a subfactor under technical) with an assigned relative order of importance for small business participation as it relates to the other source selection evaluation factors as stated at FAR 15.304(c)(3)(ii) and (c)(4).

When evaluating small business participation, solicitations must be structured to give offers submitted by small business concerns the highest rating for this evaluation factor in accordance with FAR 15.305(a)(5). In addition, small businesses are not required to submit any information (see C.F.R.125.3(g)(3)) in connection with the small business participation evaluation factor or required to submit a proposed Small Business Participation Commitment Document.

Proposal Submission Instructions. The submission instructions should be written clearly enough to indicate that:

o Other than small business contractors may achieve the small business participation goals through subcontracting to small businesses.

o Small business contractors may achieve small business participation goals through their own performance/participation as a prime and also through a joint venture, teaming arrangement, and/or subcontracting to other small businesses.

Small Business Participation Commitment Document (SBPCD). The SBPCD format is designed to streamline and bring uniformity to responses and evaluations for small business participation when required under FAR 15.304. The format provides clarity that is distinctly different from the Small Business Subcontracting Plan required for other than small businesses. (See FAR 52.219-9)

A sample SBPCD format is located at Appendix F and can be provided in the instructions to offerors or as an attachment to the RFP. NOTE: The SBPCD is to be rated acceptable/unacceptable. (Ref DoD Source Selection Procedures 2.3.2.8 and 3.1.4.1.2. Table 6).

Subcontracting Plan. Separate from the SBPCD, other than small business offerors must also submit a small business subcontracting plan meeting the requirements of FAR 52.219-9 and DFARS 252.219-7003 (or DFARS 252.219-7004 if the offeror has a comprehensive subcontracting plan).

o Other than small businesses must submit acceptable subcontracting plans to be eligible for award. Subcontracting plans shall reflect, and be consistent with, the commitments offered in the SBPCD.

o When a specific small business is identified in a proposal, the same small businesses identified and considered in the evaluation shall be listed in the subcontracting plan submitted pursuant to FAR 52.219-9 to facilitate compliance with DFARS 252.219-7003(e).

o The Subcontracting Plan is determined acceptable / unacceptable (See FAR 19.705-4(c)).

Drafting Evaluation Criteria (Section M or Equivalent)

In Section M (or equivalent) of the RFP, clearly state how each factor will be evaluated and the relative importance of evaluation factors.

Past Performance Information . Clearly state how past performance will be evaluated, its relative importance, and how offerors with no relevant past performance will be evaluated. Consider the following when drafting this section:

Use Past Performance to streamline the source selection process. Instead of evaluating management as a separate evaluation factor, consider assessing management effectiveness in meeting Technical and Schedule requirements as part of the past performance evaluation. Using past performance in this way may, under appropriate circumstances, eliminate the need for the offeror to submit management and quality plans.

Past Performance Considerations. At a minimum, consider the offeror’s record of complying with contractual requirements in the areas of schedule, technical quality, and cost control (for cost reimbursement contracts). You may also consider the offeror’s record of business relations. Tailor the scope of the areas considered to the immediate acquisition.

Small Business Participation . Other than small businesses will be evaluated on their level of proposed small business participation in the performance of a resulting contract relative to the objectives established herein. Offerors shall submit a SBPCD which specifies the offeror’s level and degree of commitment to small business utilization/participation in performance of this requirement. A SBPCD is required from all offerors, including companies with commercial plans and comprehensive subcontracting plans.

Small businesses are not required to submit subcontracting plans but will be required to address the extent of small business performance (participation) in their proposals when required by the solicitation.

The government may evaluate:

The extent to which such firms, as defined in FAR Part 19, are specifically identified in proposals;

The extent of commitment to use such firms (and enforceable commitments will be considered more favorably than non-enforceable ones);

Identification of the complexity and variety of the work small firms are to perform;

The realism of the proposal; and

Past performance of the offerors in complying with requirements of the clauses at FAR 52.219-8, Utilization of Small Business Concerns, and 52.219-9 Small Business Subcontracting Plan.

Small business participation goals/Minimum Quantitative Requirement (MRQ) is based on market research (e.g., inclusive of researching historical data and contacting subject matter experts). Research can entail the type and complexity of work, the availability of small businesses, and their capability and capacity.

If using the percentage of subcontracted dollars for the SBPCD, the dollars should correlate directly to the percentage of subcontracted dollars in the small business subcontracting plan for other than small businesses. NOTE: DoD’s assigned subcontracting goals may be used to establish small business participation minimum goals when market research results confirms that these goals are achievable or when market research is lacking sufficient data to use another source as a baseline.

Small business prime offerors shall be advised that their own participation as a prime can be counted towards the percentages set in this evaluation factor. Small businesses shall not be required to subcontract to other small businesses in order to achieve the small business participation goals, unless small business goals are set as a percentage of planned subcontracting dollars.

Requiring offerors to provide both the percentage and the associated total dollar equivalent of work to be performed by small businesses can assist in providing consistency in the evaluation. Additionally, the information may be helpful to provide transparency for small businesses when previously performed services are currently consolidated and/or bundled into an unrestricted acquisition.

NOTE: Dollars awarded to a firm with multiple SB designations should be counted in each applicable category. For example, a firm that is a WOSB and a SDVOSB would be counted in the SB, WOSB, VOSB, and SDVOSB categories.

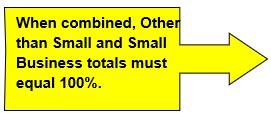

The extent of participation of small business prime offerors and small business subcontractors. The Army’s preferred methodology for evaluating small business participation goals in source selections is in terms of the percentage of the VALUE of the total acquisition. However, it is permissible to set goals as a percentage of ‘planned subcontracting’ dollars.

o Total Contract Value/Dollars Example: This scenario provides clear results for the evaluation. Scenario: Small business participation goal is set at 15% of total contract value and dollars equivalent on a procurement valued at $1,000,000:

Other than Small Business Offeror A: 20% (20% of $1,000,000 = $200,000)

Other than Small Business Offeror B: 25% (25% of $1,000,000 = $250,000)

Small Disadvantaged Business (SDB) Offeror C: 15% (SDB self-performs 15% of the $1,000,000 = $150,000)

o Sample language: The extent to which the offeror meets or exceeds the goals: Goals for this procurement are -- Small Business: {a%} of the total contract value; Small Disadvantaged Business (SDB): {b%} of the total contract value; Women-Owned Small Business (WOSB): {c%} of the total contract value; Historically Underutilized Business Zone (HUBZone) Small Business: {d%} of the total contract value; Veteran Owned Small Business (VOSB): {e%} of the total contract value; Service Disabled Veteran Owned Small Business (SDVOSB): {f%} of the total contract value. (NOTE: a participation plan that reflects {c%} of the contract value for WOSB would also count towards the overall Small Business Goal; percentages for SDVOSB also count towards VOSB).

Percentage of participation in terms of subcontracted dollars is the LEAST preferred methodology.

o Percentage of Planned Subcontracting Dollars Example: Since each offeror in the scenario below is allowed to determine how much of the work is planned for subcontracting, including small business and other than small business, using the percentage of planned subcontracting dollars methodology can provide a skewed evaluation of small business participation if not analyzed thoroughly. Percentage of planned subcontracted dollars can reflect a high percentage with low dollars going to small businesses (e.g., Other than Small Business Offeror B below), and vice versa with a lower percentage but higher dollars (e.g., Other than Small Business Offeror A below) going to small business, as shown in the scenario below.

Scenario: Small business participation goal is set at 15% of the planned subcontracted dollars on a procurement valued at $1,000,000:

Other than Small Business Offeror A: 22% (22% of $200,000 planned for total subcontracting = $44,000 small business subcontracted dollars)

Other than Small Business Offeror B: 30% (30% of $10,000 planned for subcontracting = $3,000 small business subcontracted dollars)

SDB Offeror C: 15% (SDB self-performs 15% of the total contract = $150,000)

o Sample language: (Alternate when using planned subcontracted dollars) The extent to which the offeror meets or exceeds the goals: Goals for this procurement are -- Small Business: {a%} of the total subcontracted

dollars; SDB: {b%} of the total subcontracted dollars; WOSB: { c%} of the total subcontracted dollars; HUBZone: {d%} of the total subcontracted dollars; VOSB: {e%} of the total subcontracted dollars; SDVOSB: {f%} of the total subcontracted dollars. (Note: The total must equal 100%).

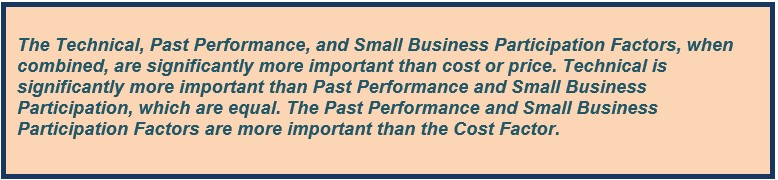

Establishing Relative Importance. When using the tradeoff process, you must assign relative importance to each evaluation factor and subfactor. Tailor the relative importance to your specific requirements.

Use priority statements to express the relative importance of the evaluation factors and subfactors. Priority statements relate one evaluation factor (or subfactor) to each of the other evaluation factors (or subfactors). Figure 2-5 below contains a sample priority statement. (Reference DoD Source Selection Procedures 2.3.3)

Reminder: Numerical weighting (i.e., assigning points or percentages to the evaluation factors and subfactors), is NOT an authorized method of expressing the relative importance of evaluation factors and subfactors (See AFARS 5115.304(b)(2)(B)).

Figure 2-5: Sample Priority Statement

2.4 Release the Request for Proposals – (No Supplemental Army Guidance)

CHAPTER 3 EVALUATION AND DECISION PROCESS

3.1 Evaluation Activities

While the specific evaluation processes and tasks will vary between source selections, the basic objective remains constant – to provide the SSA with the information needed to make an informed and reasoned selection. To this end result, the evaluators will identify strengths, weaknesses, deficiencies, risks, and uncertainties applicable to each proposal. The process of identifying these findings is crucial to the competitive range determination, the conduct of meaningful discussions and debriefings, and the tradeoff analysis described in the Source Selection Decision Document (SSDD).

Reminder: The SSEB shall not perform comparative analysis of proposals or make source selection recommendations unless requested by the SSA (Reference DoD Source Selection Procedures 1.4.4.4.3).

While the below steps are identified in a linear manner, some of the process is iterative and some steps may be accomplished concurrently. Except where noted, these steps apply to the evaluation of both the cost and non-cost factors. The groups responsible for evaluating past performance, other non-cost factors, and cost/price normally perform their evaluations in parallel. The PCO and SSEB Chairperson shall ensure that the evaluation of each proposal is performed in a fair, integrated and comprehensive manner.

Best Practice: Identify acquisition teams at the requirements development phase and provide comprehensive training on the entire process, from acquisition planning through source selection decision. Provide SSEB training covering the final RFP and SSP approximately one to two weeks prior to receipt of proposals.

Step 1: Conduct SSEB Training – Prior to receipt of proposals, each evaluator must become familiar with all pertinent documents (e.g., the RFP and SSP). Source selection evaluation training shall be provided/required for each evaluation and conducted by the PCO, at the PCO’s request, and under their supervision; the evaluation training may be conducted by another qualified source selection expert or an agency team. Training shall include an overview of the source selection process, required documents, and include a detailed focus on how to properly document rationale for the assigned rating, as well as the assessment of each offeror’s proposal’s strengths, weaknesses, uncertainties, risks, and deficiencies. Designated Legal Counsel is recommended to assist in the source selection evaluation training as well, providing content relating to ethics, procurement integrity, the protection of source selection information, and signing of non-disclosure agreements.

The training will be based on the contents of the DoD Source Selection Procedures and this supplement. Defense Acquisition University (DAU) training may be useful and can be required for SSEB members at the PCO or SSA’s discretion. Ensuring all SSEB members have current, and a standardized level of training is a priority and is especially crucial when evaluators have no previous or varying levels of prior source selection evaluation experience, as is frequently the case. Specific organization or requirement information should be included as part of the initial SSEB training.

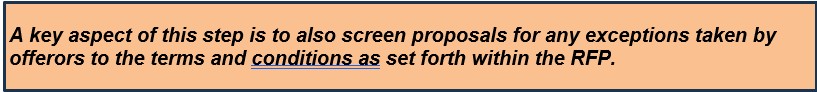

Step 2: Perform Initial Screening of Proposals – Upon receipt of proposals, the PCO or designee shall conduct an initial screening to ensure offerors’ proposals comply with the RFP instructions for submission of all required information, including electronic media, in the quantities and format specified in the RFP. The screening of prime and major subcontractor names to ensure no conflict of interest for the SST is strongly recommended, especially if contract advisors are used as part of the evaluation team. Figure 3-1 is an extract of a sample proposal screening checklist that may be used to accomplish this initial screening and should be tailored to match the specific proposal submission requirements of the RFP.

| TAB | TECHNICAL PROPOSAL | Circle Applicable Response |

| 1: Executive Summary | Does this tab include a brief synopsis of the technical proposal? Does it identify the offeror’s proposed teaming partners and/or subcontractors and discuss the nature and extent of their proposed involvement in satisfying the government’s requirements? Is a letter of commitment from each proposed team member and key subcontractor included at this tab? | Y / N Y / N Y / N |

| 2: Matrix | Does this tab include a matrix which cross-references the proposal and Volume 1 RFP paragraphs (at least all titled paragraphs)? | Y / N |

| 3: Exceptions | Are any exceptions identified at this tab? | Y / N |

| 4: Install/ Modify/ Terminate and Restore Service | Does this tab address paragraph 2.1 of the RFP? Is there a description of the format and content of a typical service restoration plan (as required by PWS para 2.1.5.a)? | Y / N |

| 5: Customer Coordination | Does this tab include a detailed description of the proposed customer coordination services…. | Y / N |

Figure 3-1: Sample Proposal Screening Checklist (Extract)

Step 3: Sharing of Cost/Price Information – The SSEB Chairperson and PCO, in coordination with the SSA, shall determine whether cost information will be provided to the technical evaluators and, if it will be provided, under what conditions, when, and what information shall be provided. The SSEB Chairperson and PCO shall ensure the small business participation evaluation team verifies the total proposed price (not individual cost elements) and any subcontracting information with the Cost/Price team. This will ensure the dollar amounts are consistent with what is being proposed in the small business participation proposal.

Step 4: Conduct Initial Evaluation – Evaluators will independently read and evaluate the offeror’s proposal against the criteria identified in the RFP and SSP, document their initial evaluation findings (e.g., strengths, weaknesses, deficiencies, risks, and uncertainties), and draft proposed evaluation notices (ENs) for each finding to be addressed, ensuring resulting narrative is sound and meaningful.

Step 5: Identify and Document Areas of the Proposal That May Be Resolvable

Through Clarifications or Communications – If information is required to enhance the government’s understanding of the proposal, the PCO may request amplifying or other relevant information from the offeror by means of the clarification or communication process (see FAR 15.306). The PCO should engage the legal advisor prior to conducting this process. (See Figure 3-3 for a detailed discussion of the differences between clarifications, communications, and discussions.)

Step 6: Assign Ratings for Non-Cost Evaluation Factors When Using the Tradeoff Process – At this point, the evaluators may or may not individually assign ratings to each evaluation factor or subfactor for which they are responsible. At a minimum, each evaluation team (factor, subfactor) must convene to discuss the offeror’s proposal. The purpose of the discussion is to share their views on the offeror’s strengths, weaknesses, deficiencies, risks, and uncertainties related to their assigned evaluation factor(s) / subfactor(s) and to reach a team consensus on findings and rating as appropriate.

NOTE : Ratings must be supported by evaluation findings and narrative statements.

Consensus requires a meeting of the minds on the assigned rating and associated deficiencies, strengths, weaknesses, uncertainties, and risks. NOTE: A simple averaging of the individual evaluation results does not constitute consensus.

In exceptional cases where the evaluators are unable to reach consensus without unreasonably delaying the source selection process, the evaluation report shall include the majority conclusion and the dissenting view(s) in the form of a minority opinion, each with supporting rationale. The report must be briefed to the SSAC (if used) and the SSA.

Step 7: Finalize ENs – ENs will include deficiencies, significant weaknesses, weaknesses (and any uncertainties not resolved through clarifications or communications) as well as ENs for significant strengths, and strengths, if dictated by the SSP.

Step 8: Prepare Summary Evaluation Reports for Each Factor – Each Factor Chair will prepare a summary report for their respective factor which provides a discussion of their associated findings. These reports will help form the Summary SSEB Evaluation Report and must be prepared at each phase of the process: initial, interim, and final evaluations.

Step 9: Prepare a Summary SSEB Evaluation Report – The final step is for the SSEB Chairperson to prepare a summary report for each proposal that includes the evaluated price, the rating for each evaluation factor and subfactor, and a discussion of the associated findings (strengths, weaknesses, deficiencies, risks, and uncertainties). A Summary SSEB Evaluation Report must be prepared at each stage of the process: initial, interim, and final evaluations.

Cost or Price Evaluation

Figure 3-2 below provides a side-by-side comparison of what price analysis, cost analysis, and cost realism analysis should include and when each must be used. For detailed instructions and professional guidance on how to conduct these analyses, refer to FAR 15.4, and the Army Cost and Price Portal on the ODASA(P) PAM Knowledge Management Portal. https://armyeitaas.sharepoint-mil.us/sites/ASA-ALT-PAM-ProcProc/SitePages/CostPrice.aspx.

| Price Analysis | Cost Analysis | Cost Realism Analysis | |

| What is it? | The process of examining and evaluating an offeror’s proposed price to determine if it is fair and reasonable without evaluating its separate cost elements and proposed profit/fee. Price analysis always involves some type of comparison with other prices; e.g., comparing an offeror’s proposed price with the proposed prices of competing offerors or with previously proposed prices for the same or similar items. | The review and evaluation of the separate cost elements in an offeror’s proposal and the application of judgment to determine how well the proposed costs represent what the cost of the contract should be, assuming reasonable economy and efficiency. | The process of independently evaluating specific elements of each offeror’s cost estimate to determine whether the estimated cost elements are: realistic for the work to be performed; reflect a clear understanding of the requirements; and consistent with the unique methods of performance and materials described in the Offeror’s technical proposal. The probable cost estimate is a product of a cost realism analysis. |

| When must you perform it? | When cost and pricing data is not required to determine if the overall price is fair and reasonable. Price realism may be performed to determine that the price offered is consistent with the effort proposed. | When Certified Cost or Pricing Data has been submitted. When Data Other Than Certified Cost or Pricing Data is submitted if being evaluated for cost reasonableness or cost realism. May also be used when a fair and reasonable price cannot be determined through price alone. (See FAR 15.404-1(a)(4). | When cost-reimbursement contracts are anticipated. Also, you may use it on fixed price (FP) incentive contracts or, in exceptional cases, on other competitive FP contracts when the Offerors may not fully understand new requirements, there are quality concerns, or past experience indicates contractors’ proposed costs have resulted in quality/ service shortfalls. However, when cost realism analysis is performed on FP contracts, proposals shall be evaluated using the criteria in the solicitation, and the offered prices shall not be adjusted as a result of the analysis. |

Figure 3-2: Comparison of Price, Cost, and Cost Realism Analysis

The following are some general evaluation guidelines and recommendations for evaluating cost/price:

The Independent Government Cost Estimate (IGE) may play a key role in cost/price analysis. It serves as a benchmark for price analysis and in cost realism and may also serve as a benchmark for individual cost elements. The IGE must contain a rationale of how it was developed (e.g., what estimating tools were used and what assumptions were made) in order to properly evaluate cost/price.

With the approval of the SSEB Chairperson and the PCO, the cost/price evaluators should coordinate with the non-cost factor evaluation team leads, as necessary, to ensure consistency between the proposed costs/prices and other portions of the proposal. This interchange between SSEB factor teams is part of the initial validation exercise and should be continued throughout the evaluation process to ensure that interrelationships are promptly identified, and the evaluation findings reflect their recognition. For example, the technical evaluation may reveal areas where each offeror’s approach is inadequate or its resourcing unrealistic, given the proposed approach. The technical evaluators and the cost evaluators should crosswalk technical deficiencies and weaknesses and their impact on cost to ensure an adequate understanding of risks and to ensure proper cost realism adjustments can be made to the proposed costs, if applicable.

When conducting price analysis, consider not only the total price, including options, but also the prices for the individual Contract Line Items to ensure they are not unbalanced. Unbalanced pricing exists when the price of one or more contract line items is significantly over or understated as indicated by the application of cost/price analysis techniques. The PCO, with concurrence of the SSA, if permitted by the RFP may reject the offer if they determine that this poses an unacceptable risk to the government. For more information on unbalanced pricing, see FAR 15.404-1(g).

For fixed-price contracts, the evaluation can be as simple as consideration of adequate price competition/comparison of proposed prices received in response to the solicitation and ensuring prices are fair and reasonable.

Pricing from proposals with marginal or unacceptable technical ratings should only be included in comparison of proposed prices after determining that the offeror included all necessary requirements in the proposed price (for example, a proposal with a significant weakness or deficiency based on a missing item, process, or labor category in the technical proposal is likely to have omitted the same in the proposed price). If only one proposal is determined to be technically acceptable, adequate price competition should not be used as the sole basis for determining price reasonableness.

For cost-reimbursement contracts, you must analyze the offerors’ estimated costs for both realism and reasonableness. In a competitive environment, the cost realism analysis enables you to determine each offeror’s probable cost of performance. This precludes an award decision based on an overly optimistic cost estimate.

Technical Evaluation

Either of DoD’s two methodologies for evaluation (Reference DoD Source selection Procedures 3.1.2.1. Methodology 1 – Separate Technical/Risk Rating Process or 3.1.2.2. Methodology 2 – Combined Technical/Risk Rating) may be utilized when evaluating proposals. The methodology chosen should appropriately ‘fit’ the individual requirement and procurement action with all factors considered.

Past Performance Evaluation

In past performance evaluations, the offeror’s performance record on similar contract efforts is examined, with the information used to reasonably predict whether the offeror will successfully perform the subject requirement. It is important to understand the difference between an offeror’s experience and its past performance – experience is what (work) the offeror has done; past performance is how well the offeror did it.

FAR Parts 9, 12, 15, 36, and 42 contain regulatory policies related to the evaluation of past performance. FAR Part 36 provides specific procedures, forms, and thresholds for evaluation of Architect & Engineering and construction acquisitions.

The Army provides source selection guidance, resources, and best practices for use by the Army Contracting Enterprise (ACE) on the Procurement.Army.Mil (PAM) platform (see https://armyeitaas.sharepoint-mil.us/sites/ASA-ALT-PAM-ProcProc/SitePages/SourceSelection.aspx).

Recency. (No Supplemental Army Guidance. – Reference DoD Source Selection Procedures 3.1.3.1.1.)

Relevance. A helpful tool that may assist in determining/verifying the relevancy of a contract referenced in an offeror’s past performance is to locate and review the contract and requirements in Electronic Document Access (EDA). NOTE: EDA requires user registration within the Wide Area Workflow (WAWF) suite of tools located on the Procurement Integrated Enterprise Environment (PIEE) site https://piee.eb.mil/. To ensure your ability to access contract records, complete this process well in advance of the start of source selection. . (Reference DD Source Selection Procedures 3.1.3.1.2)

Quality of Products or Services. (No Supplemental Army Guidance. Reference DoD Source Selection Procedures 3.1.3.1.3.)

Sources of Past Performance Information. Where possible, use past performance information available from government-wide and agency-wide databases. Use of such information will help to expedite and streamline the evaluation process.

If possible, contact two points of contact on each contract effort selected for in-depth review. The PCOs, SBPs, CORs, Fee Determining Officials, and program management office representatives are often excellent sources of information.

If multiple points of contact are providing past performance information on contract (for example, the PCO, SBP, and PM), arrange for submission of consolidated input from these sources. This may remove the need for the evaluation team to reconcile variances in past performance information submitted.

In assessing the feedback, pay particular attention to the source of that feedback and their familiarity with the requirements of the contract being assessed. For example, end users may be unfamiliar with the contract requirements or certain issues and resolution arising from contract performance may not be apparent to them.

The agency has an obligation to consider information that has a bearing on an offeror’s past performance if the SST is aware of (or should have been aware of) the information. For example, an agency may not ignore contract performance by an offeror involving the same agency, the same services, and/or the same PCO, simply because an agency official fails to complete the necessary assessments or documentation. Consult legal counsel on how to address this type of information.

Addressing Adverse Past Performance Information. When adverse past performance is obtained, as appropriate, contact the respective point of contact for that contract to obtain further information about the circumstances surrounding the situation. Additionally, and when practical, contact at least one other individual to get a second perspective on the offeror’s performance on the subject acquisition. Consider the context of the performance problems, any mitigating circumstances, the number and severity of the problems, the demonstrated effectiveness of corrective actions taken, and the overall work record.

If there is past performance information that adversely impacts an offeror’s proposal assessment, provide the offeror an opportunity to address any such information on which it has not had a previous opportunity to comment. This opportunity may occur during clarifications, communications, or discussions, depending upon whether discussions are anticipated.

When addressing adverse past performance information, identify the contract, but do not identify the name of the individual who provided the information. Summarize the problem(s) with sufficient detail to give the offeror a reasonable opportunity to respond.

NOTE: Past performance is considered a responsibility-type determination for purposes of SBA’s Certificate of Competency (COC) program, even if the next acceptable offer is also from a small business (See FAR 19.601). FAR 19.602-1(a) requires agencies to refer a finding of non-responsibility to the SBA if the determination would preclude award. Therefore, if the PCO refuses to consider a small business concern for award after evaluating the concern's past performance as a non-trade-off evaluation factor (e.g., a pass/fail, go/no-go, or acceptable/unacceptable), the matter must be referred to the SBA. Alternatively, when past performance will be an evaluation factor in the trade-off process, SBA referral is not required because the evaluation of past performance is part of a comparative, best value evaluation and not a responsibility determination.

Small Business Evaluation

The Army methodology for rating the small business participation factor is to utilize the DoD Source Selection Procedures rating scheme for Small Business Participation (See DoD Source Selection Procedures 3.1.4.1.2 – Table 6). Solely relying on acceptable/unacceptable or pass/fail rating schemes are the least preferred method of evaluating small business participation in best value tradeoff source selections. This rating scheme does not allow evaluators to give higher ratings to offerors that significantly exceed the stated small business goals or submit proof of binding agreements with small businesses and therefore are discouraged.

Additionally, small business past performance should be considered and is required in some cases (See FAR 15.304(c)(3)(ii)). In looking at small business past performance, the government evaluates how well the offeror has performed in achieving its small business goals. Remember that this should only be evaluated for other than small businesses in assessing their compliance with FAR 52.219-9. A tool regularly used by the government is the electronic Subcontracting Reporting System (eSRS).

NOTE: DFARS PGI 215.304 provides an example that indicates evaluation of past performance compliance within a separate small business participation factor. This may instead be evaluated under the past performance factor, but not in both factors .

Small business offerors (other than firms utilizing the HUBZone price preference) proposing on unrestricted requirements are not held to the requirements of FAR 52.219-14 Limitations on Subcontracting because the clause is applicable to small business set-aside procurements only. However, small business offerors should meet the small business participation factor goals through any, or a combination of the following: performance as a prime small business, performance as a joint venture, or small business subcontracting.

DoD Source Selection Procedures 3.1.6 require the offeror to include a commitment signed by both the offeror and the subcontractor certifying that, if a contract is awarded resulting from the proposal, the parties commit to joint performance as proposed when subcontractor experience is submitted for consideration as part of the proposal. If the signed commitment is not fully executed by both parties and provided with the Past Performance Proposal, subcontractor references will not be evaluated or considered.

3.2 Documentation of Initial Evaluation Results

See Army template source selection documents located in PAM - Template Library https://spcs3.kc.army.mil/asaalt/procurement/SitePages/NewTemplates.aspx).

Following initial evaluations and all required reviews (see DoD Source Selection Procedures 3.2.1), award will either be made without discussions or with discussions (see DoD Source Selection Procedures 3.2.2 and 3.2.3).

Types of Exchanges

After receipt of proposals, there are three types of exchanges that may occur between the government and offerors -- clarifications, communications, and negotiations / discussions. When they occur, their purpose and scope, and whether offerors are allowed to revise their proposals as a result of the exchanges are different for each.

Clarifications may only be used when an award will be made without discussions (see FAR 15.306(a)(1) and DoD Source Selection Procedures 3.3.1).

Communications (see FAR 15.306(b) and DoD Source Selection Procedures 3.5.2) and discussions (see FAR 15.306(b) and DoD Source Selection Procedures 3.5) are used when a competitive range will be established. All SSEB exchanges must be accomplished through the use of evaluation notifications (ENs) .

| Clarifications | Communications | Negotiations/Discussions | |

| When They Occur | Limited exchanges, between the government and offerors when award WITHOUT discussions is contemplated. NOTE: Award may be made without discussions if the solicitation announces that the government intends to evaluate proposals and make award without discussions. See section 3.3 for acquisitions with an estimated value over $100M. | After receipt of proposals, leading to the establishment of the competitive range of offerors with which the government intends to conduct discussions. May only be held with those offerors (other than offerors under FAR 15.306(b)(1)(i)) whose exclusion from the competitive range is uncertain. | After establishing the competitive range NOTE: The term “negotiations” applies to both competitive and non-competitive acquisitions. In competitive acquisitions, negotiations are also called discussions. |

| Scope of the Exchanges | Most limited of the three types of exchanges. Clarifications are not required to be held with all offerors. | Limited; similar to fact finding | Most detailed and extensive. When conducting discussions with one offeror must conduct with all offerors in the competitive range. |

| Purpose | To clarify certain aspects of proposals | To enhance the government’s understanding of the proposal by addressing issues that must be explored to allow a reasonable interpretation of the offeror’s proposal to determine whether a proposal should be placed in the competitive range | To allow the offeror an opportunity to revise its proposal so that the government obtains the best value, based on the requirement and applicable evaluation factors |

| Examples of Topics of Exchanges | Relevance of an offeror’s past performance Adverse past performance information Resolution of minor or clerical errors | Address issues that must be explored to determine whether a proposal should be placed in the competitive range Ambiguities or other concerns (e.g., perceived deficiencies, weaknesses, errors, omissions, or mistakes) Relevance of an offeror’s past performance Adverse past performance information | Examples of potential discussion topics include the identification of all evaluated deficiencies, significant weaknesses, weaknesses, and any adverse past performance information to which the offeror has not yet had an opportunity to respond. Additionally, it is a best practice to identify strengths and significant strengths to ensure that the offeror does not remove when submitting the FPR. Finally, the PCO may inform the Offeror that its price is too low or too high with the basis of these conclusions. |

| Are Resultant Proposal Revisions Allowed? | No | No | Yes |

Figure 3-3: Comparison of Types of Exchanges (After Receipt of Proposals

Conducting Exchanges with Offerors

The PCO controls all exchanges with offerors. Before participating in any exchanges, the PCO shall review the ground rules with the team members. Exchanges may be conducted in-person, telephonically, via videoconference, or via written correspondence.

During exchanges with offerors, the government may not:

Favor one offeror over another;

Reveal an offeror’s technical solution to another offeror;

Reveal an offeror’s price to another offeror without that offeror’s permission;

Knowingly disclose source selection information, or reveal the name of individuals providing past performance information;

Reveal source selection information in violation of statutory and regulatory requirements.

3.3 Award Without Discussions

Reminder: Discussions should be conducted and are the expected course of action for all acquisitions with an estimated value of $100 million or more unless inappropriate for a particular circumstance. Award without discussions on complex, large procurements is discouraged and seldom in the government’s best interest. (Reference DFARS 215.306 and DoD Source Selection Procedures 3.2.3)

3.4 Competitive Range Decision Document – (No Supplemental Army Guidance)

3.5 Discussion Process

Competitive Range

If the competitive range is further reduced for purposes of efficiency, the basis for this reduction must be adequately documented. Considerations for further restricting competition may include expected dollar value of the award, complexity of the acquisition and solutions proposed, and extent of available resources (see FAR 15.306(c)).

NOTE: Predetermined cut-off ratings (e.g., setting a minimum rating or identifying a predetermined number of offerors to be included in the competitive range) must not be established. The government may not limit a competitive range for the purposes of efficiency on the basis of technical scores alone.

The PCO, with approval of the SSA, should continually reassess the competitive range as discussions and evaluations continue to ensure neither the government nor the offerors waste resources by keeping proposals in the competitive range that are no longer contenders for award (see DoD Source Selection Procedures 3.4 and 3.5.3).

Discussions

The government’s objectives, to include the competitive range decision narrative, shall be fully documented in the prenegotiation objective memorandum (POM) prior to entering into discussions (See FAR 15.406-1 and DFARS PGI 215.406-1).

Meaningful discussions do not include advising the individual offerors on how to revise their proposal nor does it include information on how their proposal compares to other offerors’ proposals.

Additionally, discussions must not be misleading. An agency’s framing of a discussion question may not inadvertently mislead an offeror to respond in a manner that does not address the agency’s concerns, or that misinforms the offeror concerning its proposal weaknesses or deficiencies or the government’s requirements.

3.6 Final Proposal Revisions – (No Supplemental Army Guidance)

3.7 Documentation of Final Evaluation Results